Andrew Kennedy, head of Wealth Management here at EWM Financial planning breaks down asset allocation.

From Stock Picking to Asset Allocation

Building investment portfolios used to involve hiring a stockbroker to find companies to invest in, then holding onto them as they increased in value, selling them at the right time, and trying to make more good bets than bad ones.

Thankfully, the world has changed, and we no longer invest in this way. The evidence suggests that this strategy may not be effective in the long term, mainly because the efficient market hypothesis (or EMH) has shown that, over time, markets are generally efficient and that pricing arbitrage or exploitation, which active managers once depended on, no longer exists.

Why the Efficient Market Hypothesis Changed Investing

The turning point in shifting from stock-led, or bottom-up, investment was, in our view, the emergence of the index fund, whose history is brilliantly unpacked by Robin Wigglesworth in his seminal book, Trillions at https://robinwigglesworth.com/. The widespread purchase of shares by index trackers, combined with the rise of multilateral trading facilities (simply put, algorithmic traders integrated into exchanges), closed many pricing gaps. This is unpacked brilliantly in Michael Lewis’s book à Flash Boys: Lewis, Michael: Amazon.co.uk: Books.

With this push into index investing, which subsequently gave rise to the Vanguards, BlackRocks, Dimensions etc., that we have come to associate with modern, cost-led investing, came the firm establishment and testing of another premise: the decline of fundamental stock selection and the rise of asset allocation as the primary driver of returns for investors.

Three Core Drivers of Investment Returns

An investment return can be broken down mathematically; it’s that simple. It’s not a dark art or woolly science. A return is an aggregation of three parts, or perhaps just the expression of one of these three parts (which is the argument that we are presenting here).

- Stock Selection – the idea that a manager picks a stock that performs better than others; you can loosely call this bottom-up.

- Asset Allocation – the idea that geographical and sectoral allocations influence returns more than stock selection. For example, don’t buy a specific company, but consider how much to invest in the US versus the UK.

- Beta – in the most basic terms, the market return. What would the market deliver us if we did nothing?

The creation of the index fund showed that stock selectors were really up against it. – It was mathematically proven that they were unlikely to outperform the index and that beta was becoming the driving force. Essentially, mathematics revealed that, in the long run, the market would prevail.

Understanding the Market Beyond Stocks

Accepting the premise that the market wins, the next logical question is which market to buy and how to buy it. This is where it becomes complex, and asset allocation plays a crucial role.

There is no single market; rather, there are many – including bond markets, metals markets, commodities markets, and equity markets. However, generally, when people talk about the market, they refer to equity markets. Most notably, the UK market (known as the FTSE 100) and the US market (called the S&P 500) are the primary examples, although there are additional markets in both countries, such as the Dow Jones Industrial Index or the NASDAQ.

How Asset Allocation Works in Practice

Each market is monitored or reproduced by a group of asset management firms – with L&G, BlackRock, Vanguard, and HSBC being the leading names. These index funds are available to both institutional and retail investors, and it is from these fundamentals that the modern passive fund manager (multi-index fund) distinguishes itself (or claims to), by deciding on the allocation between various index trackers. This approach is known as asset allocation – essentially, it involves selecting which trackers to buy, which to overweight, and so on. These decisions harness the beta of the country or market and integrate it into a portfolio with different over- and underweights to create one return stream.

The guys who get the asset allocation right make more; those who get it wrong lose out to their peers.

Strategic vs Tactical Asset Allocation

While there are many ways to construct an asset allocation, the most common we see in our job is broken down by country, market capitalisation, and asset class. For example, US Large Cap Equity or say UK Investment Grade Credit. These decisions are usually guided by fund management teams (multi-asset teams) using two decision frameworks – Strategic Asset Allocation (SAA) or Tactical Asset Allocation (TAA).

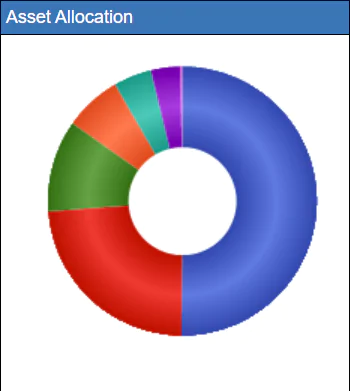

SAA is like steering an oil tanker – it involves making long-term decisions on capital market expectations and developing a framework that you can generally trust to generate returns over time. An example of one of the most significant multi-index funds, strategic asset allocation, is below.

TAA is like a tweak on small overweight and underweight areas that are applied to the SAA to optimise the portfolio.

Final Thoughts

Ultimately, the theory, supported by returns, is that focusing on AA (asset allocation) rather than stock selection (specific company) yields better long-term returns at a lower cost.

The spanner in the works of this Asset Allocation as king theory came from the introduction of factor tilting, which we will explore in the next blog – this is effectively the systematic selection of companies with the right characteristics to outperform. It is not index tracking, not active, and it’s not asset allocation—mainly because it is country-agnostic. However, it aligns with the fundamental premise of the asset allocation argument that fundamental, bottom-up stock selection by humans (typically referred to as active management) has little credible place in long-term portfolios, although it may have a role in mid- to short-term strategies.

Speak to the team

If you would like to discuss asset allocation with the team at EWM Financial Planning, get in touch!