There are numerous studies that try to answer this question. It’s a fair question but also moot in my opinion. Not surprisingly, the studies are typically conducted by financial advisers marking our own work. Most interesting is the Vanguard study as they have recently closed their Financial Planning arm but still rate Financial Planning as a value add.

From my perspective, people look for financial advice because they want to know ‘am I going to be ok?’, there is enormous value in answering this question and not necessarily quantifiable. The client is leveraging our combined financial and analytical knowledge to meet their lifetime objectives. But what do the studies say.

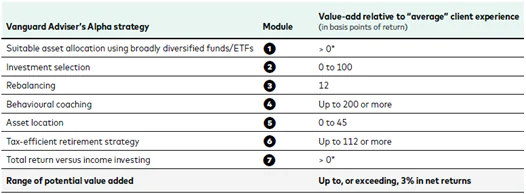

With obvious caveats, the top line figure by Vanguard’s Advisor’s Alpha® is roughly 3%.

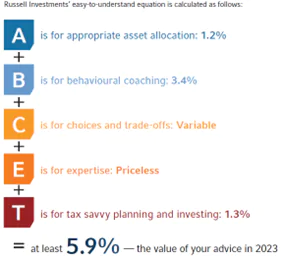

In 2023, Russel Investments proposed 5.9%.

As not all clients will tick every area the actual value add could be lower. It is thought that most return is driven by Behavioural Coaching. The number is hard to quantify, but I’d agree with the sentiment.

At EWM Financial Planning our initial fee is 2% (cap and collar of £2,000 – £5,000) and 0.80% ongoing. So, any client would want to see that investment in financial planning recuperated. If you need advice then that cost is value additive, if you don’t need advice, that cost is exorbitant.

Pete Matthew of Meaningful Money fame is very clear that not everyone needs financial advice. But, for do-it-yourself investors, a little bit of knowledge can be dangerous. We’re happy to tell prospective clients that they don’t need advice, there’s no point in wasting everyone’s time.

The basics of Financial Planning are simple.

- Earn More.

- Spend Less.

- Invest the Difference.

Taking that a step further.

- Does your Income cover Expenditure?

- Do you have a short-term cash buffer?

- Do you have cash to cover known expenses in the next few years?

- Do you have adequate Protection reviewed against the LIFE model?

When working with us, we’d also want to model a clients cashflow to age 100 with inflation built in and have honest discussions about what the accumulation and decumulation stages of their financial lives may look like (it’s not that binary though). We’d want your pensions and investments optimised and a tax strategy in place. To do this, we must know our clients well.

In conclusion, the important thing is for a prospective client to have that initial conversation with the right adviser for them. Should they like, trust and respect that adviser, based on their situation, decide if they need advice and if so, is the advice they are getting value additive.

Expert Financial Advice

EWM Financial Planning provides expert independent advice tailored to your needs, helping you plan with clarity and confidence. Contact us for an initial chat to see how we can add value to your financial journey.

Resources

- Vanguard. Adviser’s Alpha® Perspectives. Quantifying Adviser’s Alpha® in the UK: Putting a value on your value.

- Russell Investments. 2023 Value of an Adviser Report.

Meaningful Money – Making sense of Money with Pete Matthew | Financial FAQ Season 27 Episode 10 Do you need Advice?

Putting a value on financial advice — A Frugal Doctor

The value of financial advice: how much is it actually worth? | Unbiased