As expected, Reeves avoided broad income tax hikes. Whilst manifesto-breaking, this might have reassured the markets. Labour opposition meant a gentler, piecemeal approach instead. The result? A cautious budget, not disastrous, but the continuation of death-by-a-thousand-cuts that verges on a weak version of Osborne’s omni-shambles.

Broadly, gilt yields (a lagging indicator of OBR and budget confidence) show this has been received OK – this is no Truss 1.2, but it is unimpressive. The negative impact has been a lack of confidence in the run-up to the budget, but now, we need to get on with it and move on.

We’ve been battered today with explanations of what the budget means for our finances from most of the accountancy firms we work with and every national newspaper, so we’re not going to focus on that. Instead, an opinion piece would be more fun to write and spark some lively debate.

Let’s also look for the bits that aren’t that obvious.

One thing we’re interested in is thinking about what didn’t happen, the damage that was done to the UK’s retail finance in the past few weeks from ambiguity. Lastly, we have picked out a few impactful, interesting points from our financial planning and opened them up for discussion.

As always with the budget, more detail to follow…

We’d love your opinion – come and talk to us.

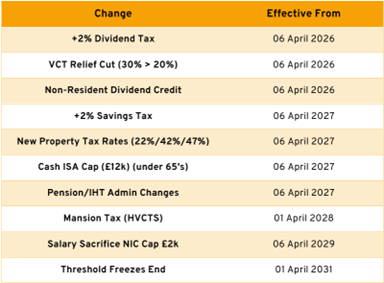

For those of you with little time or who appreciate a list, a summary of the key dates for your diary is at the bottom of this email.

Ambiguity’s Real Cost to Retail Finance

In the last few weeks, investors (and I mean the man on the street investor, not the institutions) have become worried that pensions would be raided, that tax-free cash (the 25% PCLS) would be abolished, and that they may be forced to invest a certain proportion in UK equities (not good news, I think the latest addition to the FTSE is a company that puts fish in cans, hardly Nvidia). This has led to lots of people taking out their tax free cash, which is so detrimental to both them and the UK economy as it involves selling investments to cash inside pension schemes, where they were growing nicely – totally exempt from income tax, capital gains and dividends tax – and currently IHT – and moving them into current accounts where they are fully taxable to all taxes and no longer invested in things that grow; equities (indecently these investments also drive companies forward by providing them with capital which is good news for the economy).

The second impact we have seen is a reluctance to make pension contributions. “Hey, if it’s going to be raided, I’ll put it somewhere else”. We got that a lot. We were concerned, too, but what does that mean? It simply means that people have paid too much income tax and too much corporation tax this year, as the traditional way to sidestep those was to make pension contributions. Ultimately, the easiest way to build an extensive equity portfolio is to get a lot of upfront tax relief to boost your contributions. This is the easiest way to make yourself rich in the UK, and we’ve just scared people off pensions.

The impact is in the billions, and it has flowed out of UK stock markets – contrary to what the chancellor hoped to engender with her growth strategy. Oops.

Another noticeable impact we have seen is in property: the ambiguity over rates and the mansion tax has ground the market to a halt.

Lastly, hiring has slowed amid fears of changes to employers’ NI. Job creation and hiring have hit a wall in the last few weeks.

So, What Didn’t Happen?

There’s been No solution to how farms in the UK continue for multiple generations. Yes, a mild concession was made with married couples. Instead of with the husband-and-wife thing, but ultimately, the problem is that many of the farms in the UK are worth more than £2,000,000, and taking them on from Dad, the kids will need to pay IHT in some form due to a narrowing in Agricultural relief rules. Given that farming is a tricky business, with low yields (outside of selling land for development), this kind of asset raises to cover death duties is tricky, saddling low-yielding businesses with significant debt burdens. We need our farmers, and many need our support, as the work they do doesn’t pay well. This isn’t a Robin Hood tax; you’re taking the shirt off Robin here.

No uptick in Corporation Tax – as expected.

No uptick in VAT – a shame; a broad-based, slight increase could have been beneficial. Ultimately, there is a deficit, and we need to raise money – putting this across all shoulders rather than guessing the broadest would make sense.

No uptick in Income Tax – again, like VAT, a broad-based, slight increase really could have gone a long way. It would’ve been a manifesto breaker, but what the bond market wanted (I harp on about that a lot, but they really are very powerful for all things finance). It would have been broad-based, revenue-raising, and problem-solving. Without it, we’re left wondering if there’s enough good stuff on that smorgasbord; did someone take the burger and leave us with the chips?

There has been an uptick in dividend taxation, which affects company owners a bit, but less than the hike in corporation tax from the last round. The move to equalise limited company taxation with PAYE isn’t new. The danger here isn’t the tax bills; it’s the incentivisation. We see many people returning to the corporate world now, which means they are no longer growing businesses, hiring staff, or selling businesses.

No raid on Pensions, no lifetime allowance and no reduction in the annual allowance. No change on tax relief (see note on Salary sacrifice below). The shame here is that so much damage was done in the expectation phase – this is like swerving off a road just in case there is a tree falling over around the next corner. Your bumper is still bent regardless of whether the tree fell.

Interesting Financial Planning Takeaways

Family business pass-on

The recent changes to Business Asset Disposal Relief (BADR, previously known as Entrepreneurs’ Relief) and Business Relief (BR, previously known as Business Property Relief) have not been materially altered. It’s hard to see how an SME family business gets BR assed on now on death, as the next generation has to foot a huge tax bill – probably funded from debt or asset sales. We’ve now got to consider the succession planning for the farm or the family business well in advance.

Salary sacrifice

This is going to be misunderstood, and the impact will be where we least expect it. To date, employees have been able to reduce their salaries and contribute them to their pensions. This basically means that they don’t need to pay income tax on that, and nobody has changed that. One still gets total income tax relief if you decide to put your wages into your pension rather than take them.

However, the other thing you used to be able to get back was national insurance, both at the employer and employee levels. In short, less taxable pay = less national insurance for all parties. So, who suffers? Interesting – it’s the nation. What effectively happens now is that employers reduce their wages and/or the pension contributions they make above the mandatory auto-enrolment contributions, which means people take home a little bit less each month and will have a little bit less in retirement.

This means they are more of a draw on state-funded support (like the NHS) rather than on private support, and ultimately, they buy less stuff, which is helpful for GDP creation.

Scottish Widows has calculated that for the average 26-year-old, on the UK average of £37,430, the impact of capping salary sacrifice at £2,000 a year would mean around £32,000 less in that person’s pension pot at the age of 66 – essentially because their employer pairs their pension back to the auto-enrolment minimums. Whilst this may solve a problem now, you are damaging the retirement prospects of the man on the street and hitting long-run GDP by reducing spending power in later life.

VCT tax relief down from 30% to 20%

As many of you know, we have been strong supporters of VCT investing for the right client. A 30% upfront return from the tax relief has been helpful in the right circumstances, and if scaled correctly, we see 5% of invested assets as about the right level; they can be a great diversifier. Ultimately, it’s also nice to know that support is being given to British business. One of the key reasons why the US is just a better petri dish for serious entrepreneurs is (among some other stuff) the access to venture capital funding. VCT funds in the UK are core backers of small businesses and a significant part of our growth engine. Whilst reducing the relief is a straightforward change in practical terms, our problem with this dip in the relief is that we might not be able to make the portfolios work anymore.

Ultimately, our goal with our VCT investors (as we bore you with routinely) is the flat exit. Put £100 in, get £100 out from dividends and net asset value return. The tax relief is the cherry on top and the reason for the investment. So, in short, let’s shoot for 30%, which can then be mentally accounted for as paying the dividends tax to get money out of the company cheaply, or as clawing back some of the income tax you’ve paid. Now at 20% return, risk-reward doesn’t make sense.

If I want 20% on my £100 over 5 years, I’m getting close to that in cash yields (say 3.75% per annum for 5 years). How are you going to persuade me to fund an asset class with a high default rate for cash yields? The answer is that you’re not. I suspect that investment allocators with a sharp sense of Sharpe ratio sniffing (the return of an investment per unit of risk taken) may be looking at VCT investing in a new light today and perhaps thinking there is an easier way to get a 20% yield in 5 years! Risk weighted, the VCT investment has stopped making sense – though let’s note the start date for the change of April 2026 and grab the last 30% on offer this tax year perhaps. Who knows, maybe the likes of the Venture Capital Trust Association will be able to help Reeves understand the damage the relief drop will cause and back down on the change.

Wrap-up

It’s nice to have it out of the way and have a bit of clarity. The bond market is not going to remove her, as it did with Truss. We get that the UK needs more tax revenue and see this as necessary, and it’s a tough job – you will annoy someone in raising taxes! We are concerned that the safe conditions for creating and building businesses in the UK are under threat. Still, we recognise that this may not materially affect established businesses. We think that business sellers, owners, and farmers need to really think about how to ensure continuity across generations, and we also suspect that more businesses will be offshored or sold up to cash in entrepreneurs’ lifetimes, which is a shame and has a real impact on UK long-term employment.

Ultimately, it could have been a lot worse, and we are all now still at work, getting on with what we do. Budget and policy come and go, capitalism stays constant, and the fundamental values of good businesses, good values and exemplary client service will defeat headwinds.

If you have any questions on the budget – come and talk to us.